I remember Blockbuster going bankrupt in 2010. As a 12-year-old, this news meant the end of walking down aisles with my family, looking for the perfect weekend flick. But to Netflix, this meant their competitive market analysis had paid off.

As much as I miss my three-day VHS and DVD rentals, video entertainment has improved significantly, thanks to innovation and competitive pressure. Your industry isn't immune to change either, which is why it's so important to get ahead. That's where competitive market analysis comes into play.

Table of contents:

What is a competitive analysis?

Competitive market analysis is the process of determining who your competitors are, researching their strategies, and unpacking what they do well (and not so well).

From this process, you can learn a lot about your own company's strengths and weaknesses, as well as how to remain a strong competitor in your space. It's key to learning, growing, and staying ahead, especially in volatile industries that have to evolve and innovate with new tech. But the main thing is knowing how to analyze your market, which is what I'll be showing you how to do here.

How to conduct competitive market analysis in 6 steps

Competitive market analysis isn't just a matter of making sure you have a unique selling point. Here's how to dig into the competition and figure out where you stand—and how to stand out.

1. List your competitors

Start by creating a comprehensive list of everyone operating in your industry. You can weed out the less relevant competitors later, but for now, jot down anyone that offers similar products or services.

If you're a small local business, your competitors are located nearby—you probably know a lot about them, but at the very least, you know they exist. But for something like an eCommerce store or online service, it's important to figure out who your competitors even are.

Start with basic keyword research. Google your product category a few different ways, maybe with words like "price," "cheap," or "sale" to reinforce the commercial nature of your query.

This will help you identify any competitors and can shed some light on how saturated your industry is.

Next, categorize the companies you identify into direct and indirect competitors.

Direct competitors provide similar products or services to a target market similar to yours. For example, Gucci and Prada both offer high-end clothing and accessories to fashion-conscious consumers with high disposable income.

Indirect competitors provide different products or services (though ones that land in the same category as yours) to a target market similar to yours. For example, gyms and companies producing at-home workout equipment can be considered indirect competitors.

As the name suggests, direct competitors tend to pose a more direct risk to your business. That said, indirect competitors can still attract customers and pull business away from you. You need to identify and analyze both to truly understand your competitive landscape.

2. Identify their target markets

Sometimes, a competitor's target market is clear—especially if it's a niche brand. Take Dick's Sporting Goods—it's pretty obvious that they're targeting people who are into sports (or who want to be).

For other companies, it isn't as obvious. To determine your competitors' target markets, try the following:

Study their mission statement: Sometimes, a company's mission statement will explicitly state who their products and/or services are designed for. And even when it isn't explicit, it will almost certainly provide a hint. Navigate to the "About" page on their website, and soak up whatever insight you can.

Analyze their voice and tone: Stoic or cheeky? Packed with jargon or written for the novice? Your competitors' tone and wording have a purpose—to get through to their target market. Read company blog posts, join their newsletters, and watch promotional video content, all the while paying close attention to who they seem to be speaking to.

Pay attention to their social media engagement: Observe who comments on their content and how they respond to those comments. The influencers they partner with can also shed light on the audience they want to reach.

3. Unpack their 4 P's

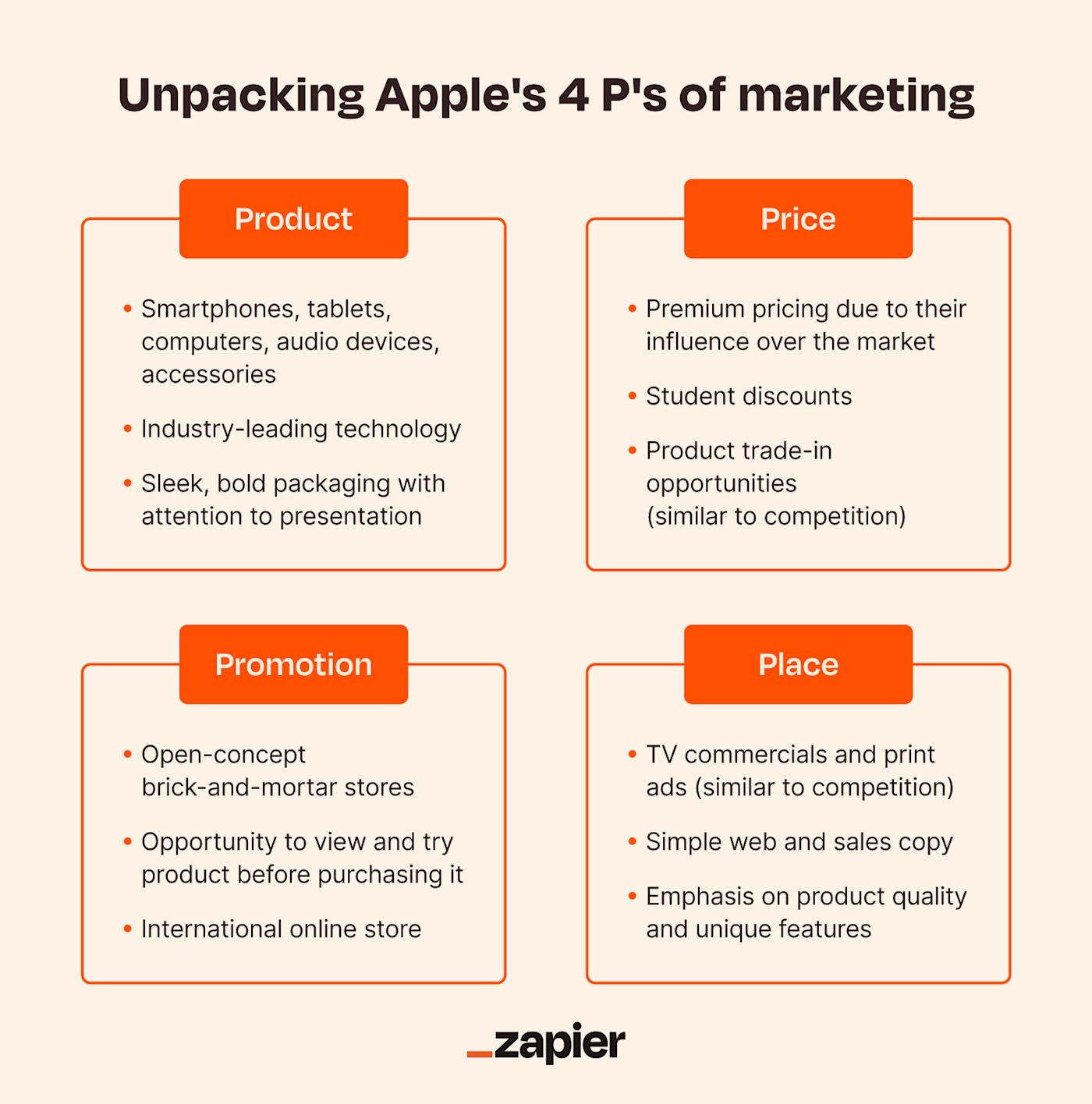

Competitive market analysis requires you to analyze your competitors' four P's of marketing: product, price, place, and promotion.

Product

The best way to learn about your competitors' customer experiences is to become a customer yourself. You'll gain incredible insights into what's working for them—and more importantly, where there's room to offer something better.

Whenever possible, give your competitors' products a spin. Get a free trial or even buy or sign up for the real deal, if your budget allows. When using their products, try contacting their customer support for additional insight.

Price

Pricing can be one of the most sensitive aspects of marketing. For this reason, you need to understand and track what your competition is doing with their pricing. Here are some questions to ask yourself about each competitor:

What's their pricing model? Subscription-style, one-time purchase, or a mix of both?

Do they seem to be using skim pricing or penetration pricing?

Does their pricing model seem to align with the rest of the industry?

There are many tools out there to help, as well as specialized tools for specific industries, like hotel room price monitoring.

Once you have a grip on your competitors' pricing strategies, here are your options:

Reduce your prices: If pricing is the only differentiator in your industry (meaning product, place, and promotion strategies are all pretty uniform), you may consider lowering your prices to snag a higher share of the market. But be wary about how this will impact customers' perceptions of your quality, as well as the risk of a price reduction competition, driving everyone's prices to unprofitable levels.

Raise your prices: If your business already leads the market by providing something unique or higher-quality products than the competition, you may consider raising your prices. Be mindful of the price elasticity of your product before pursuing this strategy, as a small price increase can lose customers in certain industries.

Match your competitors' pricing: It's much more challenging to sell products at the same price as competitors. This strategy works if your business has been in the market for a while and can make a unique or niche offer. In this case, the customer will decide to purchase based on personal preferences rather than the price.

If you feel like none of the above strategies will work for you, you might explore nontraditional pricing structures like bundling.

Place

Where are your competitors selling? Is everything online, or do they have brick-and-mortar stores?

Every industry trends differently here—shoe brands, for example, tend to have some in-person outlets since most people want to try on a pair of shoes before buying them. Furniture stores, on the other hand, don't always rely on brick-and-mortar locations. They can provide pictures, videos, and product details (such as dimensions and materials) to provide customers with a "good enough" idea of what they're getting.

Promotion

Promotion encompasses more than just advertising, but since advertising is so measurable and public, it's the easiest to spy on. To avoid wasting your advertising budget, analyze your competitors' strategies.

Here's what you're looking for:

Cost per click: If the CPC is too high, you may not want to use paid ads as a promotion channel at all. It's better to learn this from your competitors than from your own experience.

Keywords: Examine the competition level for each keyword in your competitors' ad campaigns. This will help you find the best-performing keywords with low competition (and that means lower cost per click). You'll also be able to see which keywords aren't doing well and avoid those.

Long-running ads: If your competitor keeps running the same campaign for a long time, it definitely works for them. You can try to create something similar to replicate their success.

If most competitors rely on social media advertisements as opposed to TV or print ads, you should probably follow suit. Likewise, if they're putting their entire budget into advertising how crispy their chicken sandwich is, it's probably because chicken sandwich consumers really like their chicken crispy. Watch how your competitors allocate their advertising budget and use that information to inform your own strategy.

4. Get to know their SEO strategy

SEO is a beast, and there's no surefire way to fully dissect your competitors' strategy. But there are a few ways to at least figure out what's working for them.

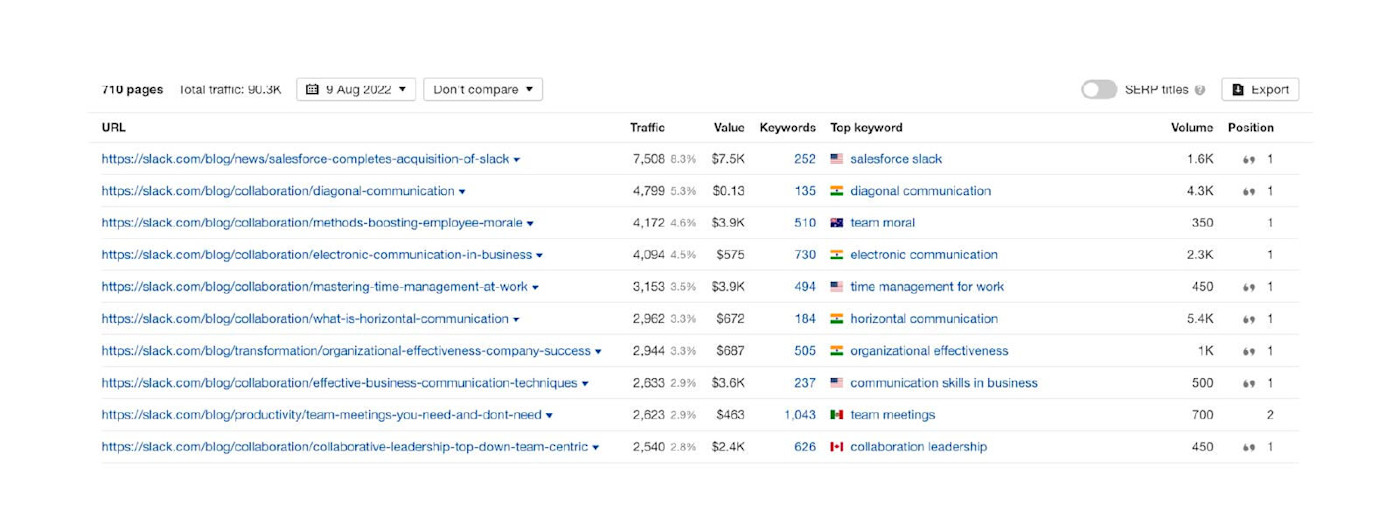

Use a keyword research tool to see what topics your competitors are ranking for. Do they rely entirely on industry-specific queries, or do they branch into other tangential topics? What pages are bringing in the most traffic?

By discovering which keywords your competitors target (and rank for), you get insight into what's working for them and uncover new keywords you might have neglected. Even better, you might also find keywords they aren't targeting and identify the underserved customers. You can also use it as a chance to differentiate your message so that you're ranking for more targeted keywords.

The Ahrefs screenshot below shows the highest-traffic-driving pages from Slack's blog. A competing communication platform could use this data to learn what's working for Slack and replicate their success. To really be successful, however, you need to one-up the competition, bringing something new to the table.

Ahrefs also lets you see your competitors' backlinks. Figure out which websites are already linking to your competitors, and then you can try to get yourself a backlink from those sites as well.

Pro tip: As you do this research, actually click into some of your competitors' high-ranking pages to see what exactly is attracting users (and Google). Data is crucial, but nothing can replace the human eye.

5. Make note of their most popular content

If you can figure out which types of content—blog posts, videos, podcasts, guides, etc.—are most popular with your competitors' audiences, that can help inform your own content strategy. And here's a tech twist: you can employ ChatGPT to run a content analysis. Simply plug in a piece of content, ask it to run the analysis, and it will quickly dissect the post, highlighting themes, patterns, and potential gaps your brand can capitalize on.

The goal is to identify which content types get the most traffic or engagement. You can use a marketing analytics tool to analyze both of those things:

Do the highest-performing pieces of content tend to all be one specific medium (video, infographic, written content, or something else)?

Do the titles of the most-shared articles all have numbers or other specific characters (like brackets or hyphens) in them?

Is the most-shared content all about a similar topic?

Let's say you run a travel blog and discover that your competitor's article called "How to save money for a trip" is super popular among their audience. You now have an opportunity to create content on a similar topic but make it even better. Maybe "The ultimate guide to traveling on a budget" or even a real story about "How 21-year-old Mike saved $10K for his epic adventure."

You should also be following all your competitors to learn more about their social media strategy, including which platforms work best for them.

Social media presents an opportunity to let your brand's voice and personality shine. Take Wendy's, for example. The brand publicly roasts its competitors on X (Twitter), and the internet loves it.

Can’t wait to watch…

— Wendy’s (@Wendys) August 22, 2024

“Any Given Day but Sunday”

a thread 🧵 https://t.co/Dc53d0b2y7

Not every brand can (or should) be quite as blunt and sassy as Wendy's, but showing some personality can pay off.

6. Conduct a final SWOT analysis

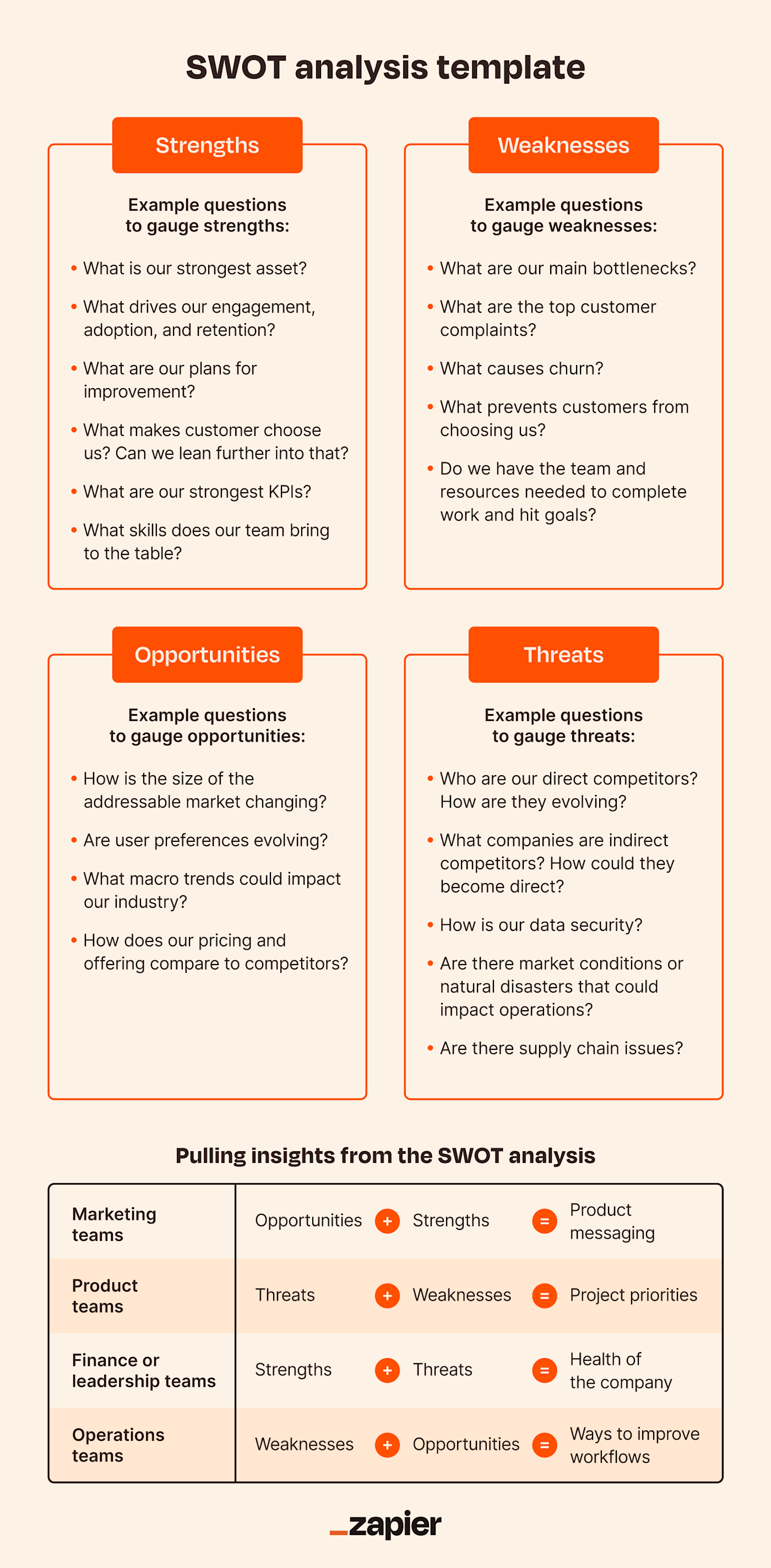

A SWOT analysis is a great way to spot opportunities to capitalize on and threats to prepare for before they strike. In short:

Strengths (S) and weaknesses (W) look internally at your company.

Opportunities (O) and threats (T) look externally to the industry and market.

While diving into your competitive market analysis, consider these factors:

Market share percentage: This metric reflects the proportion of sales a company has in the industry compared to its competitors. Tools like Statista or market research reports can offer insights into a brand's dominance or underperformance.

Competitive features: Understand the unique offerings that set a product or service apart from its rivals. Customer surveys and product comparison charts are useful methods to determine standout features.

Company culture: A company's values, work environment, and ethics can be a deciding factor for customers. Monitoring employer review sites like Glassdoor or observing a company's interactions on social media can provide insights.

Customer reviews: Customer reviews provide direct feedback on a product or service's quality and the company's reputation. Platforms like Yelp, Trustpilot, or Google Reviews offer a treasure trove of customer sentiments and concerns.

Geography (if applicable): Location can be pivotal in a company's success, especially for local businesses. Using tools like Google Trends can help identify where a product or brand is most popular geographically.

Let's be clear—this isn't going to shine a spotlight on the exact strategy you should pursue to beat your competitors. What it can do is provide a high-level look at your internal and external environment, making it easier to piece together your competitive strategy.

When promoting your brand, you're thinking about how to communicate your strengths. Conducting a SWOT analysis forces you to also view your brand with scrutiny. You may be working toward being "the best" at everything, but there will inevitably be things that other brands do better.

Download our SWOT analysis template and follow along with the example below to learn as much as possible about your brand and your competitive environment. You can also kick-start the process using ChatGPT.

The importance of competitive analysis in marketing

A deep dive into your competitors' strategies will reveal their product offerings, mission statements, target markets, marketing strategies, and more. You may even identify new competitors you didn't know existed.

Identify and fill crucial gaps in your business

The greats learn from the greats. Yes, you're trying to beat your competitors, but that doesn't mean you can't learn from them—especially if they've been around the block a few times. Seeing what works for your competitors will point toward gaps in your own strategies (as well as gaps in their strategies)—and ideally give you some inspiration on how to fill those gaps.

Spot trends and get ahead

Competitive market analysis isn't just about understanding specific competitors. It can also uncover the direction that an entire industry is moving. For example, Blockbuster didn't move with the industry, and we all know how that ended. Competitive analysis can help you avoid that same fate.

Recognize product value and pain point solutions

By analyzing competitors, you uncover customer pain points they might've missed, allowing you to refine your product's value and directly address those needs. It's not just about watching rivals, but seizing opportunities to stand out.

Set future objectives for growth

By examining market leaders, you define bold markers for your growth, and you can emulate their tactics. You can also employ AI-driven tools like Google Analytics' predictive metrics, HubSpot's forecasting tools, or IBM Watson's analytics. These tools can decipher market patterns, anticipate future prospects, and help you set precise KPIs. With AI's assistance, you can unearth data-driven insights and opportunities even top-tier competitors might miss.

Competitive analysis example

Let's say you're the CEO of an automotive company conducting a competitive analysis. After doing a deep dive into your competition and your industry as a whole, organizing your notes and SWOT analyses in folders labeled by competitor, you notice a huge push toward electric vehicles.

In fact, you estimate that your closest competitor (who targets the same market as you) now allocates over half of its advertising budget to its newest electric vehicle release. But you only have one electric vehicle option, and you only allocate 15% of your advertising budget toward it. You reasonably guess that you're in trouble.

Additional research confirms your market is very interested in making the switch to electric. You decide to reallocate your budget toward researching, producing, and promoting electric vehicles. Five years pass, and you realize you would have been left in the dust had you failed to analyze the competition or ignored the warning signs.

Competitive market analysis can prevent wasted resources, inspire new opportunities, and help you stay one step ahead of the competition. Take these six steps to better understand your company's strengths and weaknesses—then identify where you need to improve and how to invest your resources to remain a strong competitor in your industry.

Automate your operations with Zapier

Sometimes, a company's competitive advantage comes from its seamless internal operations. It can be hard to find out what's going on internally at another company, but you can be sure you streamline your own processes. Zapier lets you connect all the apps you use on a daily basis, automating workflows so you can get more done in less time. And with Zapier Interfaces and Tables, you can combine user interfaces, data tables, and logic with 7,000+ apps to build and automate anything you can imagine. Learn more about how to automate your marketing operations with Zapier.

Zapier is a no-code automation tool that lets you connect your apps into automated workflows, so that every person and every business can move forward at growth speed. Learn more about how it works.

This article was originally published by Diana Ford in May 2021. The most recent update, with contributions from Dylan Reber, was in September 2024.