App tips

16 min readThe 7 Traits of Millionaires (and 45 Apps to Help You Save Money and Build Wealth)

By Jessica Greene · February 22, 2018

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Related articles

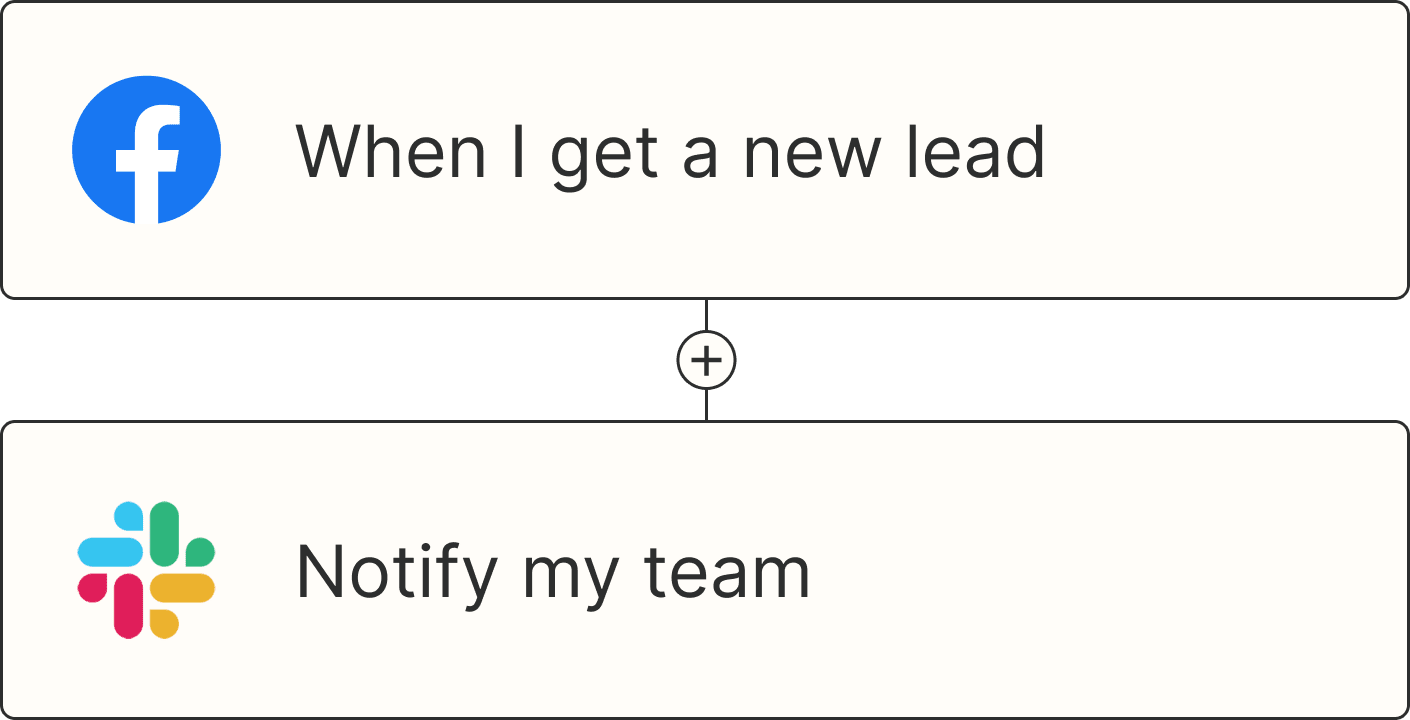

Improve your productivity automatically. Use Zapier to get your apps working together.